Archives

Filters

Recent Articles

EV Maker Beating Inflation

Written by

Brit Ryle

Posted May 10, 2023

It’s always something. If it’s not one thing, it’s another… If it’s not fear of a government debt default overshadowing the good good vibes from a surprisingly cool read on inflation, it’s a regional bank mini-crisis sapping the fun out of a better than expected earnings season…

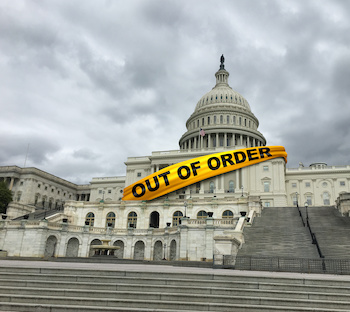

Betting On Congressional Dysfunction

Written by

Brit Ryle

Posted May 8, 2023

I keep hearing that the so-called “smart-money” is betting big money that U.S. Treasury bond prices will head lower. The rumor mill has been spinning the story that hedge funds have taken massive short positions on Treasury bonds that will pay off when bond prices fall.

Yeti Vuitton

Written by

Brit Ryle

Posted May 5, 2023

Brand identity is a powerful force, and I love consumer discretionary stocks for their potential to gain customers for life. Like Crocs (NASDAQ: CROX), Starbucks (NASDAQ: SBUX) and Louis Vuitton (NASDAQ: LVMH). Not that I think Yeti will be the next Louis Vuitton…

Breaking Out...Or Breaking Down

Written by

Brit Ryle

Posted May 3, 2023

The 52-week high for the S&P 500 is up around 4,300. One year ago, on Star Wars Day (May the 4th) 2022, the index closed exactly at 4,300. Then on August 16, the S&P 500 closed at 4305, after failing to move above the 200-day moving average, which, on that day, stood at 4,325. Both of the highs – May 4 and August 16 – were followed by some pretty nasty drops.

Asleep At The Wheel?

Written by

Brit Ryle

Posted May 1, 2023

With the fire sale purchase of First Republic Bank, JP Morgan’s (NYSE: JPM) CEO Jamie Dimon told the world that “This part of the crisis is over…The American banking system is extraordinarily sound.” Well. I know I feel better. Don’t you?

AI - Artificial Inflation

Written by

Brit Ryle

Posted April 28, 2023

Pepsi’s Frito-lay division reported a 16% gain in revenue even though sales volume was flat from the year before. It would be interesting if I could tell you that the revenue gain came from some startling Artificial Intelligence application that boosted margins for Dorito’s. But there was another kind of AI at work – artificial inflation.

Pittsburgh Rare Market

Written by

Brit Ryle

Posted April 26, 2023

As investors, we try to come up with the perfect recipe for selecting the companies we invest in. Rising dividends, expanding market share, positive cash flow, whatever it may be. And there are plenty of examples of great investors we can learn from and copy. Warren Buffett is a common example, and for very good reason. He follows a simple recipe and he knows exactly what the final dish will look like.

Is It Really that Bad?

Written by

Brit Ryle

Posted April 24, 2023

If you wanna get a laugh from your family, friends or co-workers today, I’ve got a sure-fire way you can get at least a small grin from even the most cynical and humorless person you know… Tell ‘em you’re bullish on stocks.

A Dull Market

Written by

Brit Ryle

Posted April 21, 2023

I don’t mind telling you – this has been one of the least enjoyable weeks to write about the stock market in a long while. Trading has been directionless. I’ve watched at least two dozen upside breakouts for individual stocks fail. And despite the clear unwillingness to take stock prices higher, the bears have been unable to get a decent sell-off going…

Today's Trading Plan (April 19, 2023)

Written by

Brit Ryle

Posted April 19, 2023

A month ago, investors thought THE Charles Schwab Corporation might be the next banking domino to fall. Shares were crushed from $75 down to $50. But its earnings report Monday makes that +30% drop look a little overdone.

The Truth About Rare Earths

Written by

Brit Ryle

Posted April 17, 2023

The notion that China is somehow in the driver’s seat is laughable. China’s position in the economic warfare vehicle is more like a grungy teenager on a skateboard clinging to the bumper: it’s only along for the ride, and if things get bumpy, it will end up with a face full of asphalt.

More China Selling

Written by

Brit Ryle

Posted April 14, 2023

Right now, we’ve got American owned shell companies funneling U.S. tech to Russia to build the bombs that rain down on Ukraine. Tankers brimming with Russian oil are welcome in India and Turkey. Income mutual funds feast on that 8% Altria dividend that’s driven in part by cigarette and Juul vaping sales. Two-thirds of Americans favor a waiting period for gun purchases that only 9 states’ lawmakers have approved. Walmart (NYSE: WMT) agreed to pay a $3 billion fine for dealing opioids…